Join thousands of investors targeting 5.4% - 10% p.a.

- Interest paid to you monthly

- All loans backed by U.K. property

- No investor has ever made a loss *

- Ask to withdraw at any time

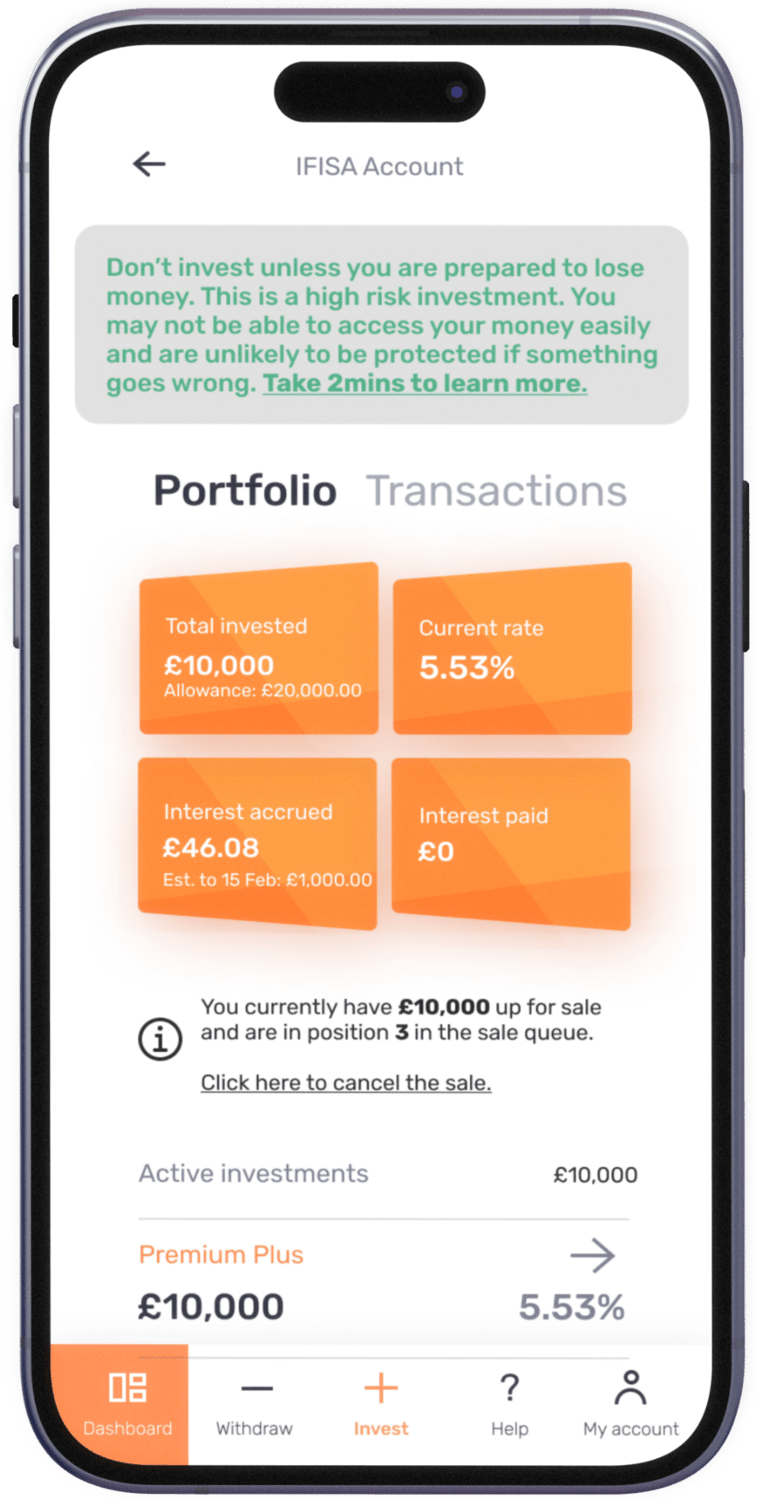

- Open a regular or tax free IFISA account

- No fees to invest or withdraw

Call our team anytime

We pride ourselves on our friendly and efficient customer service

+44 (0) 203 858 7269- £ Total loans funded

- £0.00 Investor losses

- under 24 hours Time to invest (last 12 months)

- under 24 hours Time to withdraw (last 12 months)

But don't just take our word for it

“easyMoney gives me reliable monthly returns backed by UK property”

Treating our customers fairly is our number one priority

-

We take legal charges

All our projects have first or second charges. We do not offer a provision fund.

-

We want to protect your money

Should easyMoney ever become insolvent we have arrangements in place to ensure the continued administration of each loan to help protect your money and return it to you.

-

We are not a bank

Although we are authorised & Regulated by the Financial Conduct Authority (FCA). We are not a bank and therefore investors are not covered by FSCS.